6 Simple Ways to Setting Up An Efficient Financial Plan

- Written by News Company

Your future is important to you whether or not you are young and just getting started working, or in your middle years and taking steps so that you'll have security in your later years. You want to make the best decisions when it comes to your money for both you and your family. Part of a well-rounded financial plan is also ensuring that your assets are protected and will be distributed according to your wishes, which can be achieved through proper estate planning.

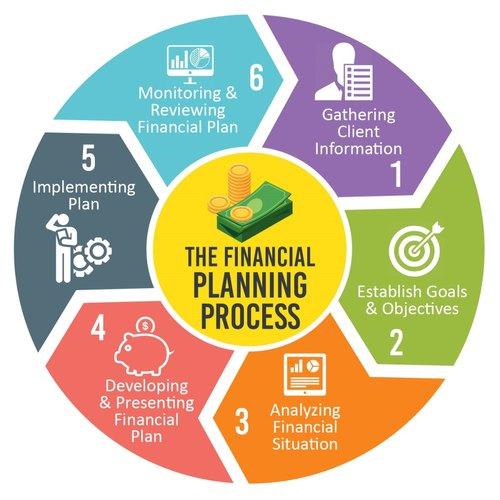

Here are six steps that will guide you into making efficient and solid decisions for you and your loved one financial future.

1. Frame your goals.

Having your goals written down is one of the best things you can do for your financial future because knowing your goals will keep you from overspending. Whether it is to buy a house someday, a trip to Europe, money for your children's college educations or plans on retiring early, you want to have those plans written down, and the due date that you hope to accomplish them. Be careful with having a generalized goal. Instead start small and build. You're more apt to accomplish what you set out to do if you're not overwhelmed by your own goals. Writing out your financial goals helps you to visualize them. Also, if you write down your goal, you’re more likely to be motivated into making them happen. Another benefit is that it helps you to be aware of the progress you’re making.

2. Life Insurance.

When making plans that deal with your financial future, you should include life insurance as one of the steps. Life insurance can help out with extra income after a spouse died. If one member of a breadwinner is no longer living that could bring a strain on a family. Life insurance can ease some of the financial stress. Other benefits include if you’re paying more for added premiums then your cash value grows. Life insurance also provides extra cash for an emergency, money for small business and investment for you. For example, singapore life insurance offers an investment factor. So do your homework and know the features of your life insurance.

3. Get rid of debt.

No debt means more money to save and invest in your future. By having no debt, you’re not only securing your financial freedom but relieving yourself of stress. Getting out from under debt means, you’re also educating family members on the value of not being in debt. Think about it, the money you’re paying on those high-interest credit cards could go for your dreams instead. Yes, it may take a while, but it is well worth the wait when your bills are gone, and the money you’re saving increase. Find the right debt strategy for you and start working on it. One way to pay off debt is through something called the debt snowball. David Ramsey explains the method in detail. There is even a free website named Credit Sesame that can sketch out which one of your bills you should pay first along with giving you an outlook on the interest rate you owe for each bill.

4. Invest in your future.

Don’t just put your money into a bank. Invest your money and commit to it. By investing your money over the long term, you’re accumulating wealth. One of the best vehicles to invest your money is a 401k plan especially when your boss matches the amount you put in. Other ways to invest include bonds and stocks both will help grow your wealth, but you don’t want to have all your assets in one area. It’s always best to diversify your funds, so you might also want to look into the likes of getting yourself an ETH Wallet or similar cryptocurrency wallets and start investing in cryptos, as well as other emerging markets to completely diversify for the best potential of profits.

5. Start planning for taxes.

You worked hard for your money, and you don’t want your nest egg to dwindle due to paying taxes. You want to make sure your money is there for you. There are ways where you can reduce your taxes or not pay any on the money you’re saving. You might consider opening up a Roth IRA. Remember you pay taxes on everything but if you do your Roth IRA correctly, you can have your money tax free.

6. Watch your spending and cut back.

Beware of your spending habits. Examine how much money you need to live off on and break any bad habits when it comes to overspending. It could mean your financial independence sooner. A few tasks to help you cut back on spending are the following: Do you really need that daily cup of coffee at your local Starbucks? If there are two of you bringing in a paycheck, consider living off one and using the other person’s paycheck to save for the future. Living below your means now gives you a brighter future later on where your money is a concern.

Decrease your spending practices by eliminating some of the things in your home that cost money such as magazine subscriptions. Consider cutting the cord when it comes to television. Instead of getting a monthly cable bill, you might want to try less expensive options. A monthly subscription from Hulu can be less than 6 bucks. Other ways of spending less money include cutting back on your utility bills, drive a used car, eat at home more often, use coupons to save on food and other items.

Remember your future is in your hands.