As at 8 January, GDA Secures 84.1% of MAHB Shares

Offer extended to 17 January 2025. Offer Price remains firm at RM11.00 Per Share

The encouraging level of acceptances by the First Closing Date, despite the intervening holiday period, moves the Consortium decisively towards satisfying the 90% acceptance condition and thus the threshold required to de-list MAHB pursuant to the Offer.

For shareholders who have yet to submit their acceptances, the Consortium wishes to highlight that the offer period has been extended from 8 January 2025 to 17 January 2025. Save for the extension, all other terms including the offer price of RM11.00 and the 90% acceptance condition remain unchanged.

RM11.00 offer price higher than any price MAHB has traded

GDA remains firm that its offer price of RM11.00 per share is highly compelling and attractive to shareholders (see Chart #11). RM11.00 is higher than any price MAHB has ever traded at and represents a 49.5% premium YTD2 and implies a Price-to-Earnings ratio of 37.7x3.

All 14 licensed equity research analysts that currently cover MAHB4 have target prices that are either lower than or equal to RM11.00, and most also explicitly recommend that shareholders accept the offer.

MAHB needs to address shortcomings to compete regionally

The Consortium reiterates its view that MAHB's shortcomings in maintaining its core assets and systems, and prolonged history of underperformance both operationally and financially, will only be properly addressed if it is not constrained by a public market listing and is able to take a fresh approach.

A case in point is the Aerotrain at KLIA Terminal 1 which has suffered multiple service failures over the last 10 years and continues to be challenged by ongoing and unresolved issues. As it nears the second anniversary of total service suspension, the re-opening date remains uncertain.

The Consortium believes one of the root causes of MAHB's issues is its continuous underinvestment in critical operational infrastructure and in projects to drive growth and expansion.

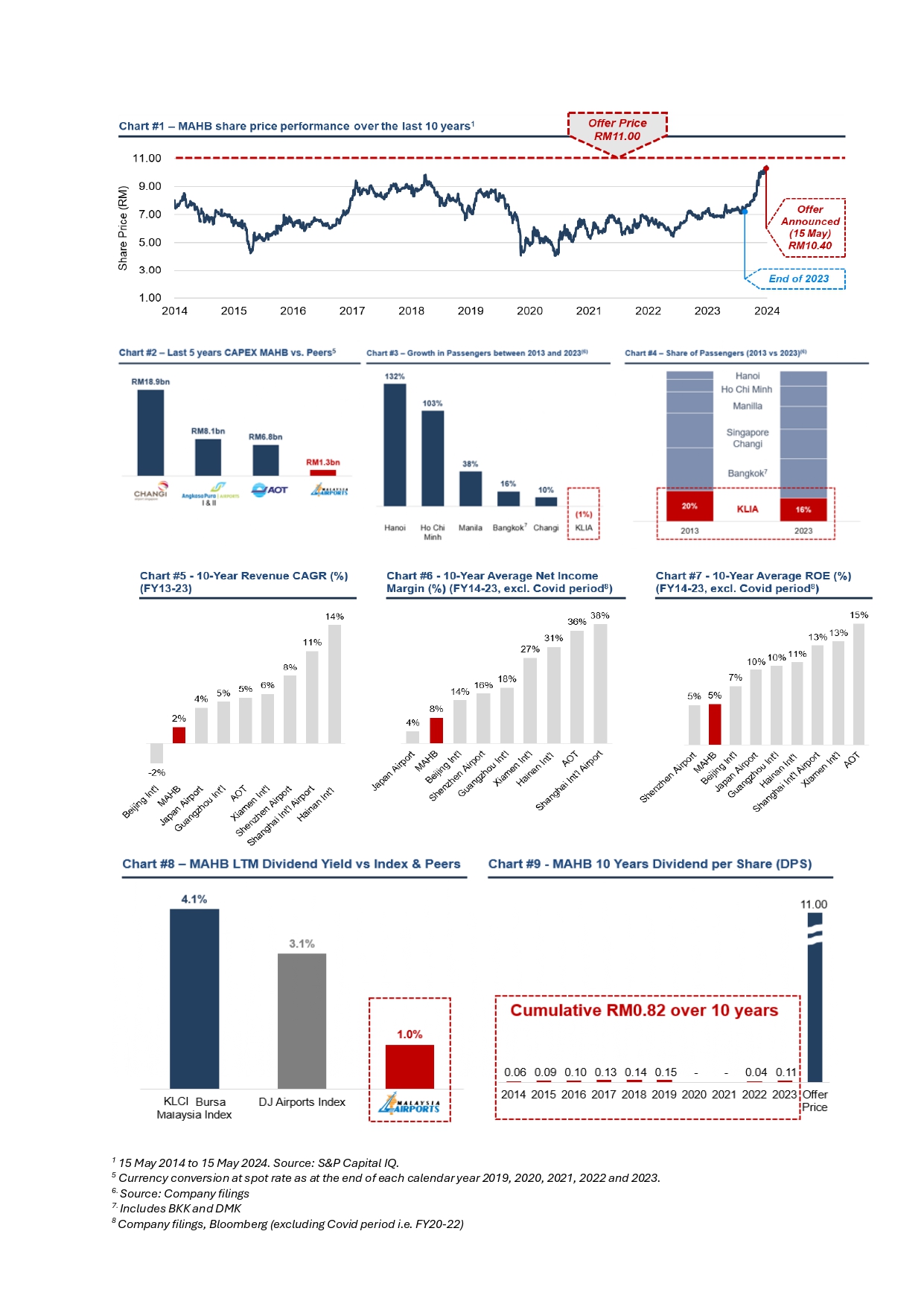

Over the last 5 years, MAHB spent RM1.3bn in capex compared to RM18.9bn by Singapore's Changi, RM8.1bn by Indonesia's Angkasa Pura and RM6.8bn by Airports of Thailand ("AOT")5 (see Chart #2).

This prolonged underinvestment by MAHB has resulted in an ageing asset base and led to a number of high-profile operational failures. Meanwhile, the passenger experience has deteriorated markedly, as noted by Skytrax whose ranking of KLIA has plummeted from 2nd best airport in the world in 2001 to 71st in 2024. MAHB's airports are in urgent need of significant remediation and expansion capex.

Unsurprisingly, MAHB has been losing ground in the ASEAN aviation market. Over the last 10 years, KLIA has lost passengers while key regional peers have grown significantly6 (see Chart #3). This has resulted in MAHB's market share declining from 20% to 16%7 (see Chart #4). Throughout this time, KLIA's regional peers, including Changi Airport in Singapore and Suvarnabhumi Airport in Bangkok, continue to make significant investments to increase their capacity and further distance themselves from KLIA.

Operational challenges have contributed to MAHB's financial underperformance

Over a 10-year period8, MAHB has consistently underperformed listed APAC peers across a number of key financial metrics (see Charts #5 - #7):

Moreover, MAHB's dividend has remained stagnant over the last 10 years and MAHB distributed only RM0.11 per share in 2024. This implies a 1.0% dividend yield9, which is four times lower than the KLCI Bursa Malaysia Index10 and three times lower than the DJ Airports index11 (see Chart #8). The RM11 per share offer price compares to RM0.82 of dividends MAHB has paid over the past 10 years (see Chart #9).

Consortium committed to turnaround MAHB

As highlighted in the offer document dated 6 December 2024, the Consortium intends to upgrade and modernise MAHB's operations, enhance passenger service, improve airline connectivity and stimulate traffic growth. The Consortium believes that such objectives will be best achieved by MAHB as a private entity, taking a long-term approach to decision-making and capital investment, and benefitting from GIP's airport expertise.

With its combined resources, control of the board and without the constraints of a public market listing, the Consortium together with management will be able to expedite necessary capital investments and provide the requisite technical expertise to realise MAHB's full potential.

This offer presents a compelling opportunity for MAHB shareholders to achieve immediate and attractive returns and GDA therefore encourages all shareholders who have not yet accepted the offer to do so before the revised closing time and date of 5:00 p.m. (Malaysian time) on 17 January 2025.

The issuer is solely responsible for the content of this announcement.