How to tweak JobKeeper, if we must

- Written by Steven Hamilton, Visiting Fellow, Tax and Transfer Policy Institute, Crawford School of Public Policy, Australian National University

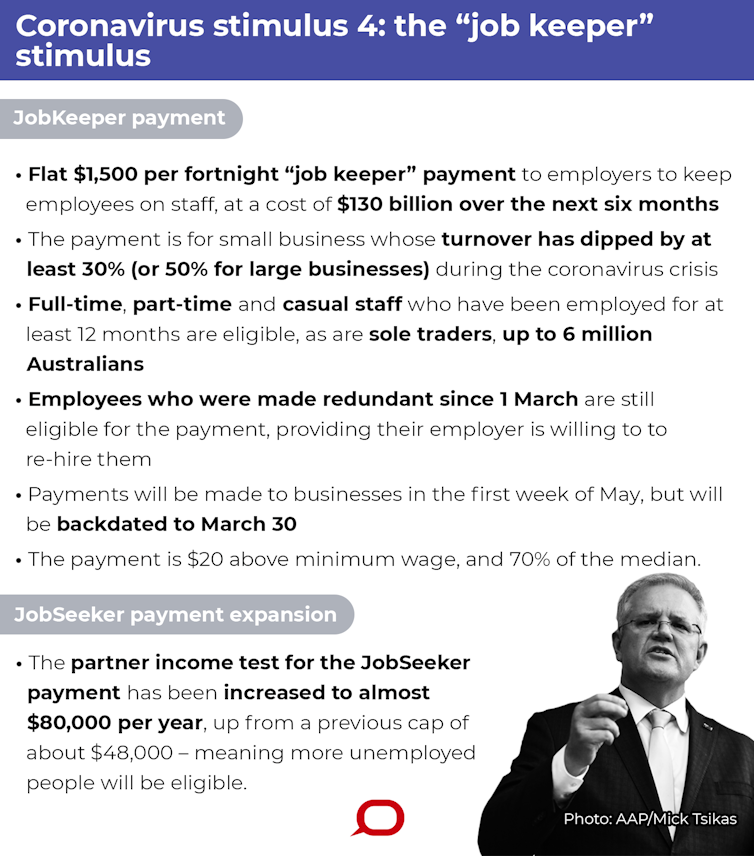

JobKeeper was always quick and dirty. Its design was far from perfect, with shortcomings I and others cautioned against.

These were forgiven in the face of an impending calamity, but the health interventions have worked so well the generosity of the economic interventions is being reconsidered.

In light of a report the treasury is reevaluating the design of JobKeeper, it’s worth setting out where the scheme falls short and how it could be tweaked.

The fixed per-worker subsidy was a bad idea

The big flaw in JobKeeper is that it is paid as a fixed amount per worker, regardless of the hours worked or wage earned.

The COVID-19 economic crisis stems from businesses losing money and laying off workers due to a lack of customers – either voluntarily or by government fiat.

The ideal response would be to replace that lost revenue on the condition that businesses maintain their workers’ hours and wages.

Read more: That estimate of 6.6 million Australians on JobKeeper, it tells us how it can be improved

With that condition, there would be no need to tie the amount of the subsidy to the number of workers on the payroll.

Doing so will save some firms and their workers’ jobs. But those with low margins and large fixed costs such as rent will be undercompensated, and others will be overcompensated.

Forcing firms to pay the entire subsidy to their workers (even where it means giving them a pay rise) limits their ability to use it to offset other costs. And it leads to all sorts of inequities among workers.

The Conversation, CC BY-ND

If the scheme must be tied to payroll, there are far better ways.

It could instead cover a portion of total payroll up to a ceiling with some additional support for non-payroll costs, of the kind offered in the United States and other countries.

To ensure no business got too much, the entire payment could be capped so the business made no more under JobKeeper than it did before the crisis.

Pay it up front and tax it back later if need be

Most businesses are eligible for JobKeeper if they expect turnover to fall by at least 30% in the coming quarter (or month if turnover is more than $20 million).

If things go better than expected and they end up not needing that much JobKeeper, they get to keep what’s been paid to them for the entire six-month period, as long as their expectation was genuine.

As the advice from the Tax Office puts it:

We will accept your assessment of these turnovers, unless we have reason to believe that your calculation of your projected GST turnover was not reasonable.

But reasonable expectations are hard to police.

A better approach would be to pay businesses up front some proportion of total payroll for the same time period in the previous year.

Then, after the fact, what they are eligible for could be calculated based on actual payroll.

Any difference could be reconciled through the ordinary tax return process. Anything overpaid could be taxed back and any extra due could be paid out.

This would be simpler, clearer and better targeted, and solve the cash-flow problems businesses are complaining about.

Six months won’t be long enough for some

The scheme is set to end after six months on September 27 regardless of economic conditions.

Some businesses in some sectors are already back at work and others will come back soon. But some, such as those affected by the international travel ban, will be out of action until next year.

For those businesses that recover quickly, support will be provided long after it is needed. But for some others, the maximum six-month time frame will be too short.

A better approach would be to tie the duration to objective benchmarks tailored to particular sectors (such as the end of the international travel ban, for instance).

Extend it to workers who have missed out

Short-term casuals, most temporary visa holders, workers at certain foreign-controlled businesses, and employees at most universities were left out despite many of them working in the hardest-hit industries.

The reported underspend on JobKeeper makes these omissions all the more puzzling.

Read more:

Why temporary migrants need JobKeeper

There was never a good reason – morally or economically – to exclude these people, and the budgetary constraint has turned out not to be an issue.

If changes to JobKeeper are to be made, they should be offered it immediately.

The Treasurer could fix all this, but he should wait

The JobKeeper legislation is merely a shell, with the detail stipulated in regulations imposed at the behest of the Treasurer.

This gives him discretion to make whatever changes he sees fit.

But whether he should make changes is a tough call.

There are clear flaws in the current system, and for many businesses it could be wound up earlier as the outlook has changed somewhat for the better.

Read more:

JobKeeper is quick, dirty and effective: there was no time to make it perfect

But the government made a clear commitment to these millions of businesses and workers to maintain a certain level of support for the full six months.

The last thing anyone needs right now, when the confidence of consumers and businesses is more critical than ever, is to have the government pull out the rug it extended.

While there’s a lot the treasurer could do, there’s also a good case for leaving things for now.

The Conversation, CC BY-ND

If the scheme must be tied to payroll, there are far better ways.

It could instead cover a portion of total payroll up to a ceiling with some additional support for non-payroll costs, of the kind offered in the United States and other countries.

To ensure no business got too much, the entire payment could be capped so the business made no more under JobKeeper than it did before the crisis.

Pay it up front and tax it back later if need be

Most businesses are eligible for JobKeeper if they expect turnover to fall by at least 30% in the coming quarter (or month if turnover is more than $20 million).

If things go better than expected and they end up not needing that much JobKeeper, they get to keep what’s been paid to them for the entire six-month period, as long as their expectation was genuine.

As the advice from the Tax Office puts it:

We will accept your assessment of these turnovers, unless we have reason to believe that your calculation of your projected GST turnover was not reasonable.

But reasonable expectations are hard to police.

A better approach would be to pay businesses up front some proportion of total payroll for the same time period in the previous year.

Then, after the fact, what they are eligible for could be calculated based on actual payroll.

Any difference could be reconciled through the ordinary tax return process. Anything overpaid could be taxed back and any extra due could be paid out.

This would be simpler, clearer and better targeted, and solve the cash-flow problems businesses are complaining about.

Six months won’t be long enough for some

The scheme is set to end after six months on September 27 regardless of economic conditions.

Some businesses in some sectors are already back at work and others will come back soon. But some, such as those affected by the international travel ban, will be out of action until next year.

For those businesses that recover quickly, support will be provided long after it is needed. But for some others, the maximum six-month time frame will be too short.

A better approach would be to tie the duration to objective benchmarks tailored to particular sectors (such as the end of the international travel ban, for instance).

Extend it to workers who have missed out

Short-term casuals, most temporary visa holders, workers at certain foreign-controlled businesses, and employees at most universities were left out despite many of them working in the hardest-hit industries.

The reported underspend on JobKeeper makes these omissions all the more puzzling.

Read more:

Why temporary migrants need JobKeeper

There was never a good reason – morally or economically – to exclude these people, and the budgetary constraint has turned out not to be an issue.

If changes to JobKeeper are to be made, they should be offered it immediately.

The Treasurer could fix all this, but he should wait

The JobKeeper legislation is merely a shell, with the detail stipulated in regulations imposed at the behest of the Treasurer.

This gives him discretion to make whatever changes he sees fit.

But whether he should make changes is a tough call.

There are clear flaws in the current system, and for many businesses it could be wound up earlier as the outlook has changed somewhat for the better.

Read more:

JobKeeper is quick, dirty and effective: there was no time to make it perfect

But the government made a clear commitment to these millions of businesses and workers to maintain a certain level of support for the full six months.

The last thing anyone needs right now, when the confidence of consumers and businesses is more critical than ever, is to have the government pull out the rug it extended.

While there’s a lot the treasurer could do, there’s also a good case for leaving things for now.

Authors: Steven Hamilton, Visiting Fellow, Tax and Transfer Policy Institute, Crawford School of Public Policy, Australian National University

Read more https://theconversation.com/how-to-tweak-jobkeeper-if-we-must-138321