the Reserve Bank's plan for when cash rate cuts no longer work

- Written by Isaac Gross, Lecturer, Monash University

The coronavirus has pushed economies and interest rates into downward spirals.

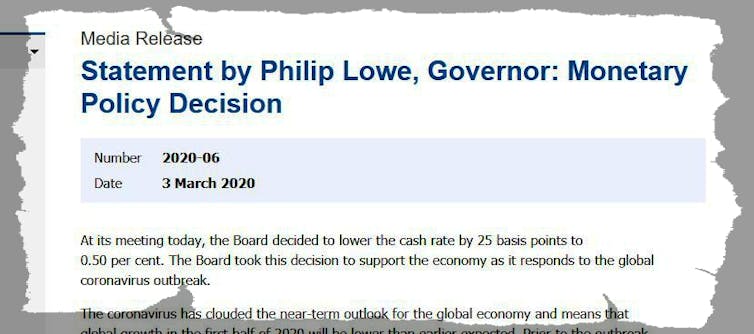

New Zealand’s Reserve Bank pushed its cash rate from 1.00% to 0.25% on Monday, and the US Federal Reserve cut its benchmark rate to zero on Sunday, making Australia’s cut of 0.25 points from 0.75% to 0.50% earlier this month seem tame by comparison.

Australia’s Reserve Bank is highly likely to cut again on Thursday as part of a promised series of “policy measures”, but it has already said that 0.25% will be the effective lower bound for the cash rate (meaning the point at which there’s no benefit to further cuts) leaving it staring into the abyss of so-called unconventional monetary policy.

It will outline what it will do after 0.25% is reached on Thursday, but in the meantime a series of clues suggest its thoughts are changing.

Read more: Now we know. The Reserve Bank has spelled out what it will do when rates approach zero

In November Governor Philip Lowe indicated that after the bank’s short term cash rate had reached the effective lower bound, the bank would buy longer-term government bonds. That would force money into the hands of the investors who owned them in a process known as “quantitative easing”.

But more recently it is talking about borrowing an idea from the Bank of Japan’s book called “yield curve control”.

What is yield curve control? And how does it differ from quantitative easing?

It isn’t simply buying bonds

Yield curve control would involve the bank announcing targets for long-term yields on government debt instruments such as the 5 or 10-year bond, and then intervening in debt markets to buy until the target rates are achieved.

This would control the yield on government bonds, hence the name “yield curve control”.

Read more: Reserve Bank and government prepare fresh emergency measures as markets tumble

Both quantitative easing and yield curve control involve the same basic tactic (pushing out or creating money in order to buy bonds) but to different ends: yield curve control focuses on achieving a targeted level for interest rates, while quantitative easing is aimed at increasing the stock of money in the economy.

Why might the bank prefer yield curve control over the traditional approach to quantitative easing that has been used in much of the world during and since the global financial crisis?

It’s more like what we are used to

First, yield curve control’s approach of targeting specific interest rate is more similar to conventional monetary policy.

The bank has plenty of experience in setting and publishing the cash rate and measuring the impact on the economy. There is less risk of it either over or under shooting its target.

Previous work by the bank has calculated that adjusting the 10-year nominal interest rate is 40 times as effective at lowering firms’ cost of capital as a similarly sized cut in the cash rate.

This leaves the bank with plenty of ammunition after short-term rates hit the effective lower bound and can no longer be adjusted.

And it lets others do the work

The second reason to prefer yield curve control is that if the bank’s stated target for long-term interest rates is seen as credible, it will need to buy less than it would have to achieve lower interest rates.

So credible have its short-term cash rate announcements become that it now needs to do little more than make them and watch the market trade at changed rates, although it stands ready to trade itself in order to change the rates if needed.

It’s instructive to compare recent cash rate announcements with the early ones in the 1990s.

These days the bank simply says it has “decided to lower the cash rate”.

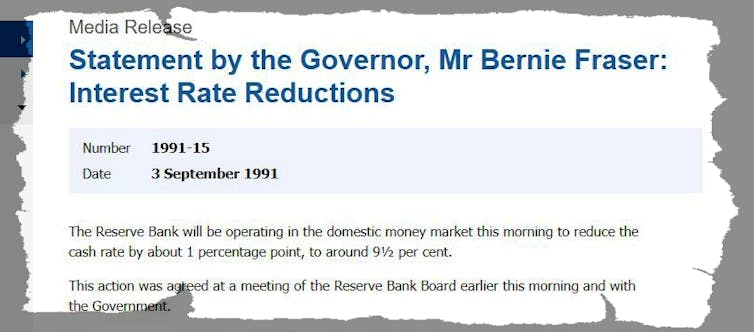

It used to say it “will be operating in the domestic money market” to reduce the cash rate.

It used to say it “will be operating in the domestic money market” to reduce the cash rate.

Government bonds are the lifeblood of the financial system and right now Australia has relatively low levels of government debt.

An approach which requires fewer bonds to held by the Reserve Bank and more held privately will keep down government debt and help steady financial markets.

It’s good, but it mightn’t be enough

As it happens, yield curve control might not be sufficient on its own.

The interest rate on 10-year bonds are already low - at about 1% - and so even there there isn’t much room to cut.

While negative interest rates are possible and exist in several other countries (yes, investors really are prepared to invest their money with the government for a negative return) the bank is unlikely to want to is unlikely to want to introduce them here.

Ultimately, if it needs to do more than get bond rates to near zero per cent, it’ll need to come up with something new, but yield curve control will buy it time.

We’ll know more on Thursday.

Government bonds are the lifeblood of the financial system and right now Australia has relatively low levels of government debt.

An approach which requires fewer bonds to held by the Reserve Bank and more held privately will keep down government debt and help steady financial markets.

It’s good, but it mightn’t be enough

As it happens, yield curve control might not be sufficient on its own.

The interest rate on 10-year bonds are already low - at about 1% - and so even there there isn’t much room to cut.

While negative interest rates are possible and exist in several other countries (yes, investors really are prepared to invest their money with the government for a negative return) the bank is unlikely to want to is unlikely to want to introduce them here.

Ultimately, if it needs to do more than get bond rates to near zero per cent, it’ll need to come up with something new, but yield curve control will buy it time.

We’ll know more on Thursday.

Authors: Isaac Gross, Lecturer, Monash University