Steady Growth in Investment Activities in 1H 2022, Full-Year Transaction Volume Expected to Reach HK$70 billion

East Rail Line Extension to Drive Future Capital Appreciation in Adjacent Districts

HONG KONG SAR - Media OutReach - 24 May 2022 - Global real estate services firm Cushman & Wakefield today presented its 1H 2022 Hong Kong investment market overview and forecast. Impacted by the fifth wave of the pandemic, investment activities in Q1 2022 were slowed down, dampening the large deal transaction (deal size of over HK$100 million) count in the quarter. However, although this period has delayed investors’ decision making, it has not diminished investment confidence in the city. Investment activities in Q2 picked up demonstrably, showing promising signs for a further recovery in the second half of the year. The full year's transaction volume is expected to reach HK$70 billion, with industrial assets and development sites continuing to be sought-after. Meanwhile, the opening of the East Rail Line cross-harbour line will also benefit and spur capital appreciation for adjoining properties.

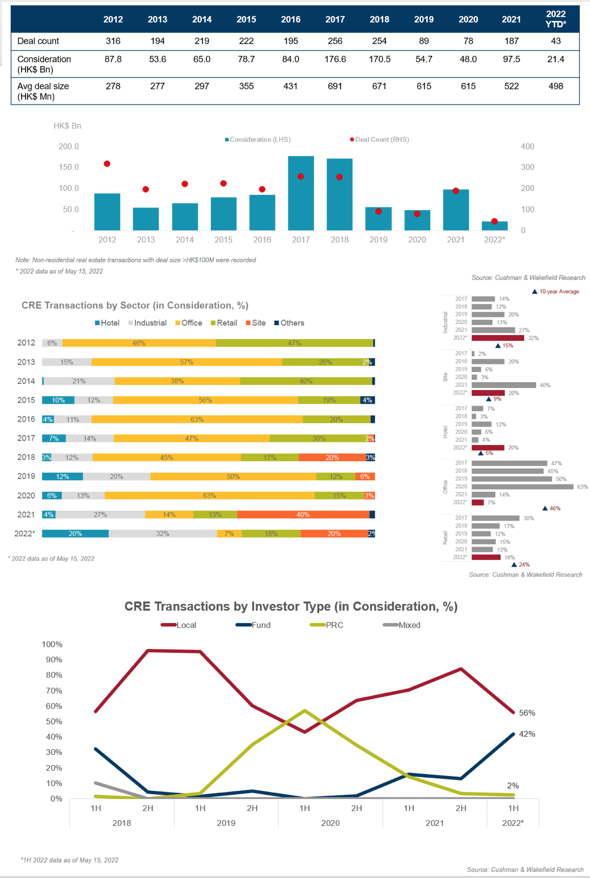

Figure 1: Annual CRE investment deals and consideration in the last decade (as of 15 May)

Figure 2: Transactions by sector in 1H 2022 vs. 10-year historical average (as of 15 May)

Figure 3: Investment transactions by investor type

Overview of 1H 2022 Investment Transactions

The fifth wave of the pandemic put investment decisions largely on hold, subsequently delaying investment activities. For the year-to-date period as at mid-May 2022, the investment market recorded a total of 43 transactions, at an average deal size of HK$498 million, recording a total consideration of HK$21.4 billion (Figure 1).

Keith Chan, Director and Head of Research, Hong Kong, Cushman & Wakefield said, “The average deal size has trended downwards due to the continuation of the pandemic, as investors buckled up and focused on investments with smaller capital lump sums. We expect that the large transaction deal count will reach 50 deals in the first half of 2022, with total consideration forecast to hit HK$28 billion. With the pandemic being gradually contained, it is expected that the investment sentiment will improve in the second half of the year.”

Investment Transactions by Sector

Among all property sectors, industrial assets, hotels, and development sites were the most active in 1H 2022. Industrial buildings accounted for a 32% share of the total consideration, surpassing the historical 10-year average of 15%. (Figure 2). Hotel assets also saw traction, with a significant increase in deals driving a 20% share of the total consideration, up fivefold on last year on a like-for-like basis. Development sites' transaction volume also recorded a similar expansion to hotel assets, taking a 20% share of the total volume, far exceeding the average of 9% in the last decade. The key factor here has been the continuing strong self-use demand for residential properties, with developers actively acquiring suitable residential sites to meet future housing demand.

A boom in hotel transactions in the first half of the year is noteworthy, with several headline acquisitions recorded. Keith Chan commented, “The significant reduction in tourism activities has adversely affected the hotel business in the city, and many hotel owners have been willing to sell assets at a discounted price. At the same time, in light of the persistently strong housing demand, foreign real estate funds have been encouraged to collaborate and form joint-ventures (JVs) with local operators, seeking to further purchase distressed hotel properties for value-add conversions such as co-living and multi-family uses.”

Investor Breakdown

Tom Ko, Executive Director and Head of Capital Markets, Hong Kong, Cushman & Wakefield, said, “In terms of the funding sources, local investors continued to dominate the market as border restrictions remain in place, accounting for over 56% of total transactions. Nevertheless, several prominent investment funds took advantage of the quiet market and looked to bargain-hunt. During this period, funds accounted for 42% of total transactions, a significant increment of 14% compared with 1H 2021. Amongst them, most industrial and hotel deals were purchased by foreign funds forming JVs with local operators, providing financial support for business expansion. Relatively speaking, mainland China investors were quieter than last year, accounting for just 2% of the total transaction volume (Figure 3).”

New Market Spotlights

The East Rail Line cross-harbour extension, together with properties within the Northern Metropolis area, will be the future market spotlight. With the official opening of the East Rail Line cross-harbour section, the mass transportation extension to Hong Kong Island is now robust. It is expected to benefit and drive capital appreciation in properties located along the rail line, especially in the Wan Chai North district and around the Hong Kong Convention and Exhibition Centre, with the buyers’ market as the focus. In addition, the future development of the Northern Metropolis area and infrastructure provisions will further support the New Territories North area. The expected completion of the Kwu Tung station in 2027, connecting with Lok Ma Chau station, will further provide transport support to residents in the New Territories North. The Kwu Tung, San Tin, and Hung Shui Kiu areas are all expected to benefit and to attract major developers for investment.

Market Outlook

As the fifth wave of the pandemic comes under control, the investment market will gradually recover into the second half of the year. Tom Ko concluded, “Industrial properties, hotels, and development sites are expected to remain attractive for investors. Particularly, industrial assets will be a priority for investors, as their flexibility for conversion to warehouses and data centers remains popular to meet new economy demands. Development sites will be further accelerated due to future infrastructure provisions such as rail extensions, which will subsequently drive capital appreciation and population growth. Foreign funds will likely remain active, strengthening local operators for further JVs and expediting greater funds to allocate and invest in the city’s real estate market. We expect the 2022 full-year investment total transaction volume to reach HK$70 billion, outperforming 2020 and 2019 levels.

Please click here to download the photo and presentation deck.

Photo caption:

Photo: (Right to left) Tom Ko, Executive Director and Head of Capital Markets, Hong Kong, Cushman & Wakefield and Keith Chan, Director and Head of Research, Hong Kong, Cushman & Wakefield

About Cushman & Wakefield

Cushman & Wakefield (NYSE: CWK) is a leading global real estate services firm that delivers exceptional value for real estate occupiers and owners. Cushman & Wakefield is among the largest real estate services firms with approximately 50,000 employees in over 400 offices and 60 countries. Across Greater China, 22 offices are servicing the local market. The company won four of the top awards in the Euromoney Survey 2017, 2018 and 2020 in the categories of Overall, Agency Letting/Sales, Valuation and Research in China. In 2021, the firm had revenue of $9.4 billion across core services of property, facilities and project management, leasing, capital markets, valuation and other services. To learn more, visit www.cushmanwakefield.com .hk or follow us on LinkedIn ( https://www.linkedin.com/company/cushman-&-wakefield-greater-china).

#Cushman&Wakefield